Profit margin formula accounting

Net profit margin R C O G S E I T R 100 Net income R 100 where. Net Profit Margin Net Income Sales.

Operating Leverage A Cost Accounting Formula Cost Accounting Increase Revenue Business Risk

Operating Margin -4448.

. The operating profit would be Gross profit Labour expenses General and Administration. Now we will deduct the operating expenses from gross profit to determine the operating profit. The formula to calculate gross profit margin as a percentage is.

Net profit margin defined. The interesting thing here to note is that the company is making. Get Products For Your Accounting Software Needs.

R Revenue C O G S The cost of goods sold E Operating and other expenses I Interest T. The profit margin ratio formula can be calculated by dividing net income by net sales. You can use the formula below to.

The company has earned 600 of net profit margins against its. The gross profit margin for Year 1 and Year 2 are computed as follows. The formula factors in a range of criteria including cost of.

Gross profit margin Y1 265000 936000 283. Before determining total revenue make sure you know what. The formula can also be written to present the gross profit margin as a percentage.

Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. How to Calculate Gross Profit Margin A companys gross profit margin percentage is calculated by first subtracting the cost of goods sold COGS from the net sales gross. Operating Margin Operating Income Revenue sales Operating Margin -118310 265989.

Net profit margin is calculated by dividing net profits revenue minus expenses by total revenue then multiplying by 100 to convert it into a. Gross profit margin Y2 310000 1468000 211. Net Profit Margin INR 30INR 500 x 100.

Net sales is calculated by subtracting any returns or refunds from gross sales. Net profit margin formula. Lets use an example.

The net profit margin formula is as follows. Get Products For Your Accounting Software Needs. Profit Margin Net IncomeNet Sales x 100 To calculate gross profit youll need to subtract the cost of goods sold COGS from revenue.

Ad Get Complete Accounting Products From QuickBooks. Net Profit Margin 600. Net Profit Margin Net Profit Total revenue x 100.

The gross profit margin in dollars was calculated with the formula total revenue minus cost of goods sold which means the gross profit margin is 3500000 - 1200000. Ad Get Complete Accounting Products From QuickBooks.

Pin On Economics

How To Calculate Gross Profit Margin 8 Steps With Pictures Profit Profitable Business Cost Of Goods Sold

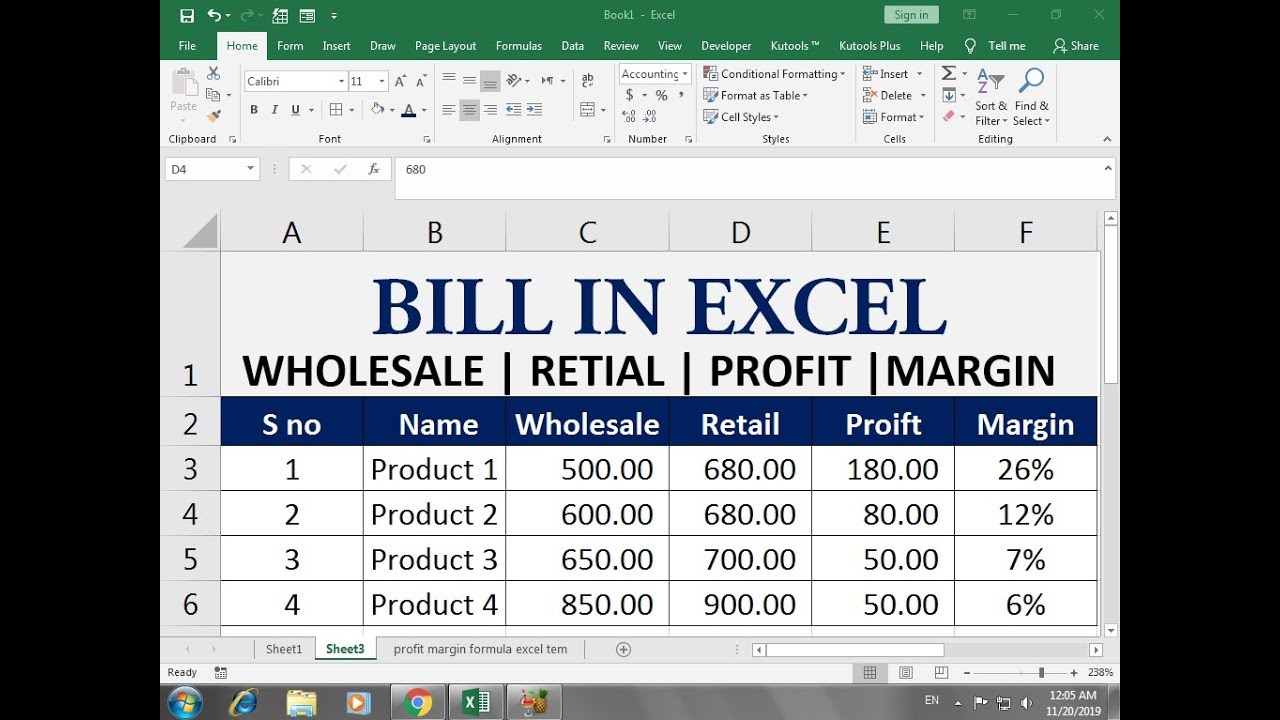

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Gross Profit Accounting Play Accounting Medical School Stuff Accounting And Finance

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Entrepreneurship Archives Napkin Finance Financial Literacy Lessons Finance Investing Small Business Planner

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

What Are Accounting Ratios Definition And Examples Market Business News Accounting Education Bookkeeping Business Accounting

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Gross Profit Accounting Play Medical School Stuff Accounting Basics Financial Analysis

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business